W-9 Form - Fill Out the IRS W-9 Form Online for 2019

Breaking down the W-9 form

Unlike many other tax forms, the W-9 is relatively easy to fill out, albeit it could be a bit baffling if you are new to working as an independent contractor. We will go into each section of the IRS form in further detail below.

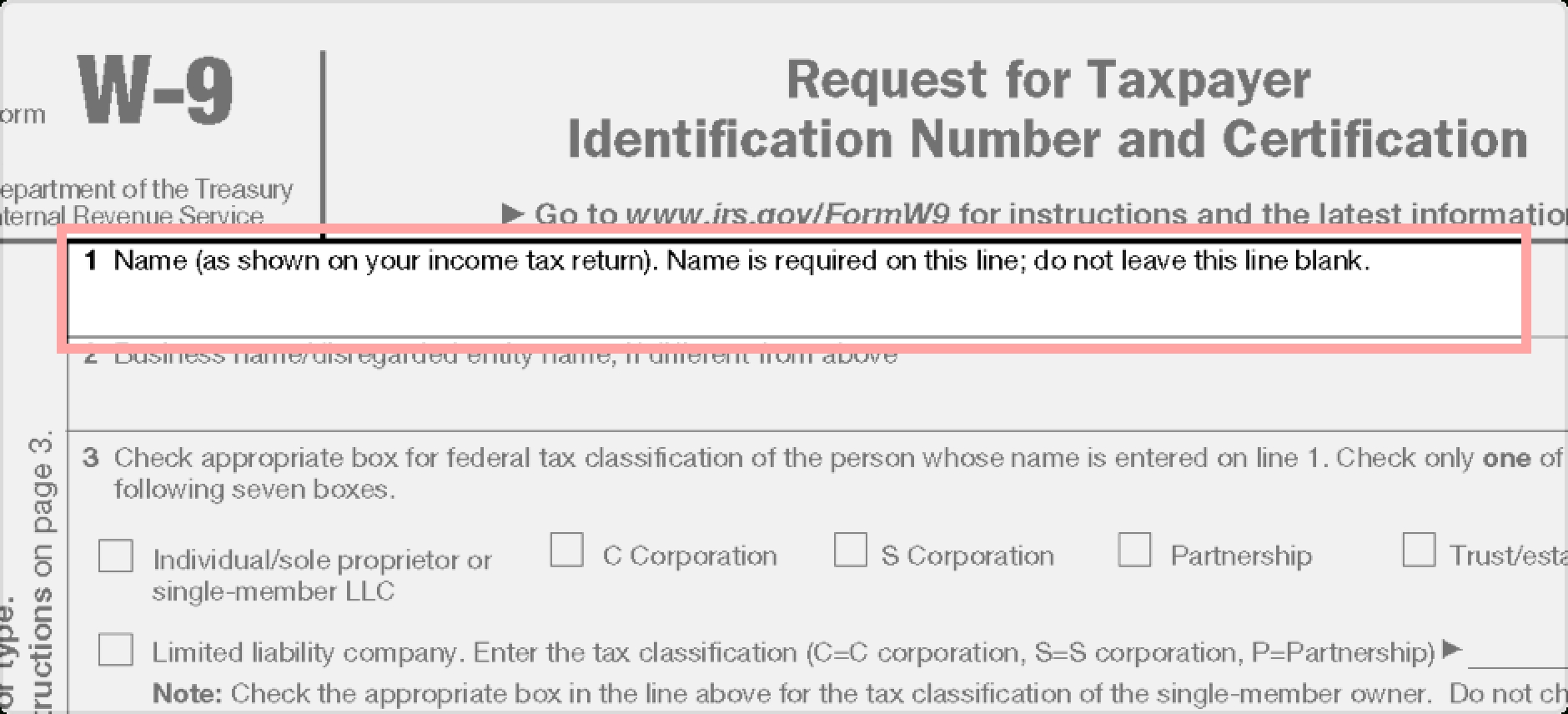

1: Name

In case your business is a sole proprietorship or a single-member LLC, and it is taxed as a sole proprietor or single-member LLC, your full legal name will go on this line. This name should match the one that appears on your tax return. On the other hand, if the LLC is a partnership, an S corporation, or another type of LLC, then your business’s name will go on this line.

2: Business Name/Disregarded Entity Name

As per the previous section, if you are filling out the W-9 as a single-member limited liability company or a sole proprietor and your legal name is in line 1, the name of your business will go on the second section. If there is a DBA (Doing Business As), you can also put it here. Conversely, if the first section contains your business’s name or you work under your name, then this section should be left blank.

3: Federal Tax Classification

This section of the W-9 refers to your tax status. Again, tick 'Individual/sole proprietor or single-member LLC' if your business is a sole proprietorship of your company. The same goes for if your LLC is a C Corporation or an S Corporation. On the other hand, if another LLC owns the LLC, then you will tick the 'Limited Liability Company' box, and then designate whether the parent company is a C corporation, an S corporation, or a Partnership, by putting in C, S, or P respectively.

4: Exemptions

This segment is for small businesses that have exempt from backup withholding or FATCA reporting, the exempt payee code or exemption from FATCA reporting code will go here. Most will leave this section blank. However, if you are unsure, please check with a certified public accountant (CPA) or an advisor from a financial institution if you need assistance on this topic.

5 + 6: Address, City, State, ZIP Code

These two sections simply contain your address. If your home address is different from your business address, use the address that would be in your tax return.

Part I: Taxpayer Identification Number (TIN)

Here, put your Employer Identification Number (EIN) if you have it. In case you are the sole proprietor of your business, you would put your Social Security Number instead. Remember that you only need one of the two.

Part II: Certification

In Part II, the information states that, by signing the W-9, you certify that the tax identification number provided is accurate, you are not subjected to backup withholding, you are a US citizen or other US person, and that the FATCA code, if any, is correct.

Upon completion, sign your signature and insert the date where it is needed.

Filling out the W-9 Form with Smallpdf

With our online PDF Editor, we have conveniently placed the latest version of the W-9 form from the IRS website (for the 2019 tax year) within the tool for you to work on. Upon entering the web tool, you may fill the blank W-9 by clicking on each box to begin entering your personal information. For the signature section, choose the 'Signature' tool (shortcut = S) to create and insert an electronic signature. Additionally, you can use the 'Free Text' tool (shortcut = T) to enter additional data onto the document.

On the other hand, if you would like to print the form out to fill in with pen and paper — click the caret located on the right-hand side of the Download button at the top left corner. There will be an option for you to print the blank and fillable W-9 form out to complete manually. You may also download the blank template, of course, so that it’s readily available on your computer.

-

-