Download form 4868 extension file online - you inquisitive

How do I file an extension for taxes?

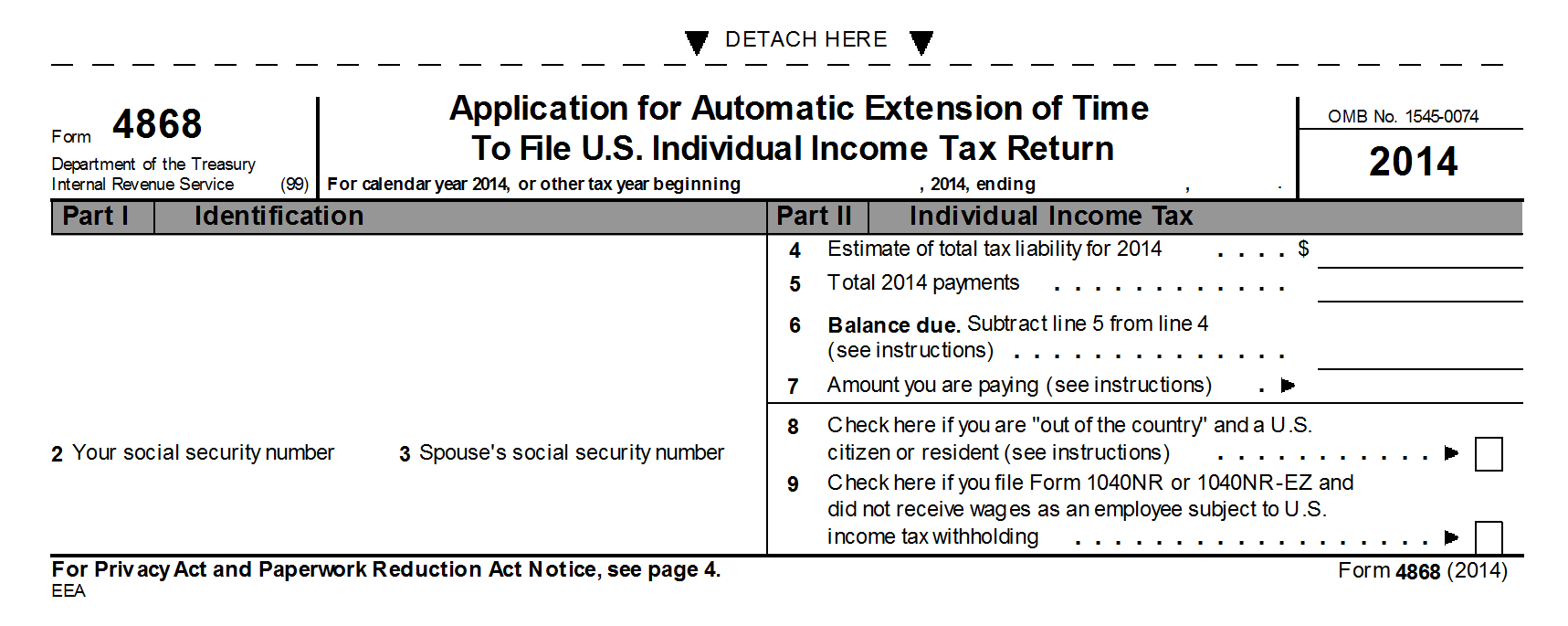

You can file an extension for your taxes by submitting Form 4868 with the IRS online or by mail. This must be done by the tax filing due date. Filing an extension for your taxes gives you additional months to prepare your return no matter the reason you need the extra time.

What is a tax extension?

When some taxpayers ask, “How do I get an extension for my taxes?” they might be thinking of the taxes owed and not the return itself.

This question calls attention to a key distinction about what a tax extension is — and what it is not. An extension only gives you more time to finish the paperwork, not more time to pay.

Your tax payment is due on April 15 or on the next business day if it falls on a weekend or holiday. (Note: For 2019 returns, the IRS extended the tax deadline due to the coronavirus pandemic to July 15. )

- If you know you’ll be getting a refund, you won’t need to worry about paying when you are filing an extension for taxes. The earlier you file your return, the earlier you’ll receive your refund.

- If you think or know you’ll owe, you should estimate your tax liability and pay the amount due when you file Form 4868.

Is there a penalty for filing for a tax extension?

Filing a tax extension is not a bad thing. There is no penalty for filing an extension. However, not paying on time or enough, or failing to file altogether, may cost you.

- If you don’t pay the full amount you owe, the IRS will charge you interest on the unpaid balance until you pay the full amount.

- If you don’t pay at least 90% of the amount you owe, you might also be subject to a late payment penalty. The penalty is usually half of 1% of the amount owed for each month, up to a maximum of 25%.

- If you don’t file either your return or Form 4868 by July 15, you’ll be subject to a late filing penalty. (Typically, the date is April 15, but for 2019 taxes in 2020, then the date was different. It was July 15, 2020.) The penalty is usually 5% of the amount you owe for each month, up to a maximum of 25%.

After you file the extension, you’ll have until October 15 to gather your documents and finish your filing. When you complete your return, you should include the amount you’ve already paid in the payments section of your Form 1040.

Can you file a tax extension online? What ways are there?

Form 4868 is the IRS document you complete to receive an automatic extension to file your return. You can file a tax extension online in one of several ways with H&R Block. While you won’t be filling out the paper Form 4868 line-by-line, your tax extension information will be sent online to the IRS.

Here’s how to get an extension on your taxes with H&R Block*

- File your tax extension online on your own – Start with an existing H&R Block Online account or create a new one to submit your extension. If you’ve filed with us online in the past, this experience will be familiar to you. Our program will ask you all the relevant questions, so you can file your extension with the IRS.

- File your tax extension with a tax pro virtually – Work with H&R Block to connect with a remote tax expert who can submit your tax extension for you. If you haven’t started your return with Tax Pro Go, select the version of Tax Pro Go for your situation and complete the initial information. Then once you’ve created your account, send your tax pro a secure message to request the extension. Already working with a pro? Simply connect with them to determine if an extension is necessary.

- Have a local tax pro file your extension – Work with your current tax pro to file your extension virtually. Log into your MyBlock account and send your tax pro a secure message to request the extension.

Don’t live in the United States? Find out how to file an extension when you’re living abroad from our Expat Tax Services team.

* Fees may apply.

0 thoughts to “Download form 4868 extension file online”